Join 3,000+ subscribers

Featured in

Congrats, you got the job. All that Leetcode paid off and you managed to negotiate a higher salary without vomiting on the phone. The bag has been secured.

Well, not quite – one technicality remains: the background check.

With “Just trust me, bro” not being an acceptable answer, your future employer will now use public databases and court records to dig up skeletons in your closet. They’ll even contact your old employers and verify that the information you provided is accurate.

This is the status quo. Whether you go work for Amazon or a 10 person startup, it’s deemed acceptable because, well, everyone else does it.

But it always struck me as strange that whilst your future employer can launch a private investigation into your past, you only get a glimpse into theirs. There’s only so much you can learn from rosy career pages and recruiter emails.

Today, we’re going to run our very own background check on a startup. We’ll dive into funding rounds, scrape Glassdoor reviews, peruse court records and assemble our own dream team of lawyers, venture capitalists, and culture experts.

Will the startup pass or fail? Let’s find out.

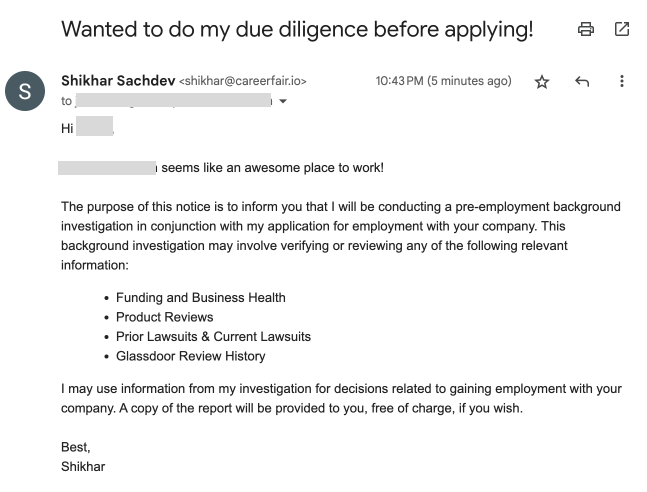

Asking for permission

When a company runs a background check on you, they are legally bound to inform you in writing that a background check will be run for employment purposes (per the FCRA).

I decide to send over my very own notice to a recruiter at this startup, outlining my ambitions to find out as much as possible about them.

Let’s be clear: there’s absolutely no need for me to do this. It is completely unnecessary. But as my best friend’s cousin, Dave, once said: do it for the story.

I find an example letter for background checks, flip it, and email it to a recruiter at this startup.

And off the email goes. The startup is:

- VC backed with prominent investors

- Mid-late stage, Series C

- Operates in the tech enabled healthcare staffing industry.

The startup has a mobile app that connects nurses with open shifts at healthcare facilities, essentially operating as a B2B marketplace. They make money by taking a % of the amount paid out to the nurses.

A few hours later, with still no recruiter response to my notice, I start brainstorming what this background check might look like.

The Anatomy of a Background Check

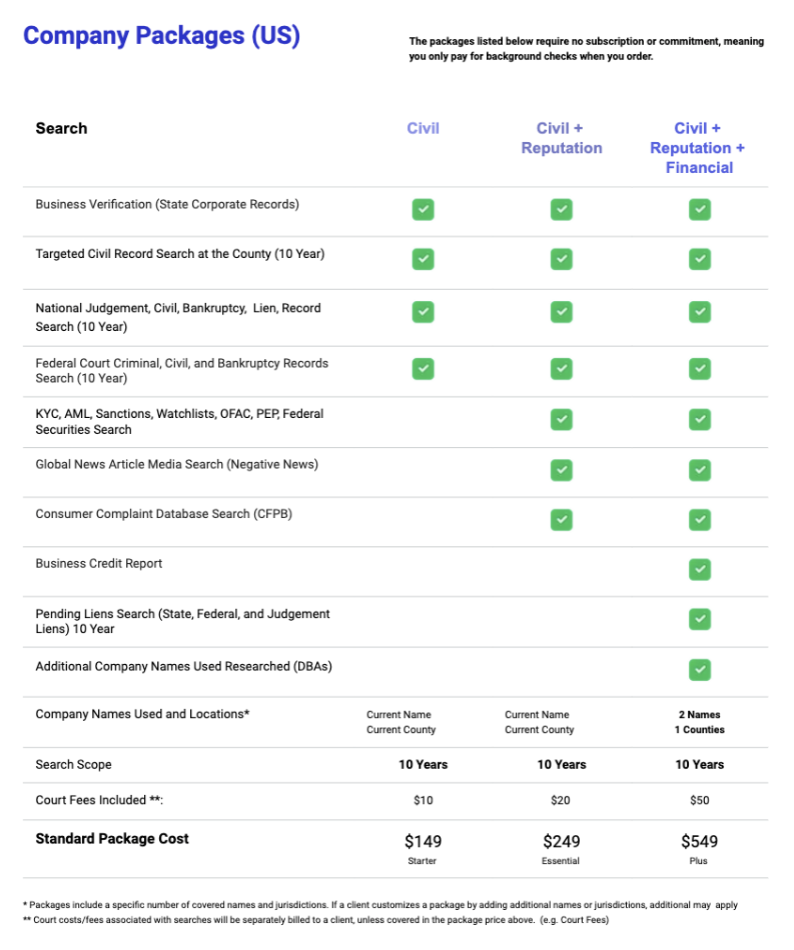

As a starting point, I find business background check services.

These sort of checks verify the business’ criminal records, credit report, and perform basic KYC. They cost roughly between $200-$700 and can get you the following information:

As a job candidate, though, the above doesn’t really include what I want. I can design my own background check which is going to focus on the following:

- Financial → can the startup sustain itself financially? Will they do layoffs? Is the market they’re in growing? Will their valuation continue to grow?

- Legal → are they in any legal trouble that I should be aware of? Is there any legal exposure that might harm the business in the future?

- Employee Culture → is this the sort of place I want to work? Are there any red flags I can garner from previous reviews? Will I be paid fairly?

These are similar to the kinds of questions a Venture Capitalist (VC) might ask. If you join a company you are making a very concentrated investment in the future of that company, so it makes sense to think like an investor.

And unlike a VC, you don’t even get to diversify your portfolio.

Legal

Most court documents in the United States are available to the public. They aren’t very easy to read, but they are indeed public. Websites like PACER.gov, JudyRecords, and UniCourt allow us to electronically access these documents.

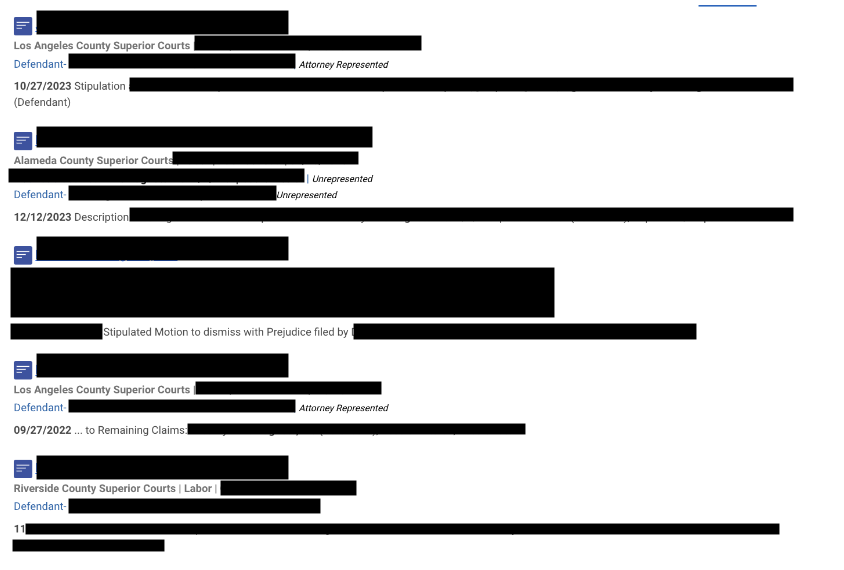

Typing the startup’s name into the above sites returns over 12 class action lawsuits against them:

A class action lawsuit is a type of lawsuit where one of the parties is a group of people who are represented collectively by a member of that group. In this case, the lawsuit represents nurses who have used the app to find shifts at healthcare facilities, but have been treated unfairly.

Specifically, most of them are tied to the misclassification of nurses as 1099 contractors instead of regular W2 employees. This is the same issue that similar gig-economy apps like Uber and Lyft have run into. The argument goes like this:

- Typically, 1099 contractors are rideshare drivers or food delivery couriers. However, many healthcare staffing firms (like this startup) have been classifying the nurses they provide to hospitals as 1099 contractors.

- Since 1099 contractors are treated as self-employed people, staffing firms aren’t obligated to pay them any minimum wage or overtime requirements.

- This saves the staffing firms money and helps their bottom line.

- However, it seems wrong to classify nurses as 1099 contractors instead of regular full time W2 employees because nurses working at these healthcare sites abide by a lot of regulation and domain specific rules.

Some of these class action lawsuits are pretty hefty - the largest one having been settled for over $2M about a year ago.

I don’t know about you, but as a mere muggle with little knowledge of the legal system, I see “class action lawsuit” and get scared. Who would want to work for a startup that’s had to deal with this sort of stuff? $2M sounds like a big number.

This wouldn’t be perfectly accurate. Companies like Uber and Lyft have paid out over $320M in settlement fees over class action lawsuits just this past year. Does this mean that you shouldn’t accept an offer from Uber? Obviously not.

To find out more, I reached out to Dane Steffenson. Steffenson was a trial attorney at the Department of Labor for nearly 20 years — he has litigated more than 250 cases, many with damages exceeding a million dollars.

According to Steffenson: “I think it’s very difficult to have a person working in a healthcare facility and not have them be a W-2 worker. That facility is facing liability if they choose to do that.”

Currently, the arbitration agreements the startup has in place (which require that persons who signed them resolve any disputes outside of court) allow them to settle the lawsuits they get for small amounts and limit their liability. For example, the $2MM they settled with should have been much larger, according to Steffenson.

The only way this startup could be majorly affected is by a lawsuit from the Department of Labor (DoL) – “one main lawsuit from the department of Labor could end their entire practice” claims Steffenson. This is because the DoL has the ability to get an injunction, which would prevent the startup from being able to misclassify their workers and restrict their practice.

Other similar startups, like ShiftMed, already classify their workers as full time W2 employees. It might be a “safer” bet to join these companies due to the fact they wouldn’t have this legal exposure. And in fact startups like ShiftMed have been pushing the DoL to force down on companies that misclassify.

Investigations by the DoL are not public, but just recently they announced a new rule that threatens to severely impact gig worker classification, potentially harming this startup and their business model. According to Steffenson, the rule helps clarify and strengthens the DOL’s position that the workers are not independent contractors.

As a job seeker, I would ask the following questions if I was interviewing here:

- Are you aware of any open investigations into your practice from the DoL?

- What do you think about this new rule that the DoL has formulated? How will it impact your business and profitability?

- Do you foresee healthcare facilities not wanting to work with you because they take on all the liability as per your terms & service agreements for the nurses you connect them with?

Overall, my background check confirms that it is unlikely that any sort of class action lawsuit would wipe out the startup. The real risk lies in investigations pursued upon by the Department of Labor, which is certainly something I’d press the startup on as recently there has been more activity in this sector.

I’d also look into competitors like ShiftMed that don’t face this issue of misclassification - they might be a safer bet to join.

Financial

Operating under the assumption that you want to work for a startup that won’t run out of money, we want to focus on the following few things:

- Funding & Valuation (down rounds, investor pedigree, valuations)

- Evaluating the business model (revenue growth, revenue type, costs)

- The state of the market (growth & outlook)

Funding & Valuation

Let’s start by examining how much money this startup has raised and what growth stage they’re in.

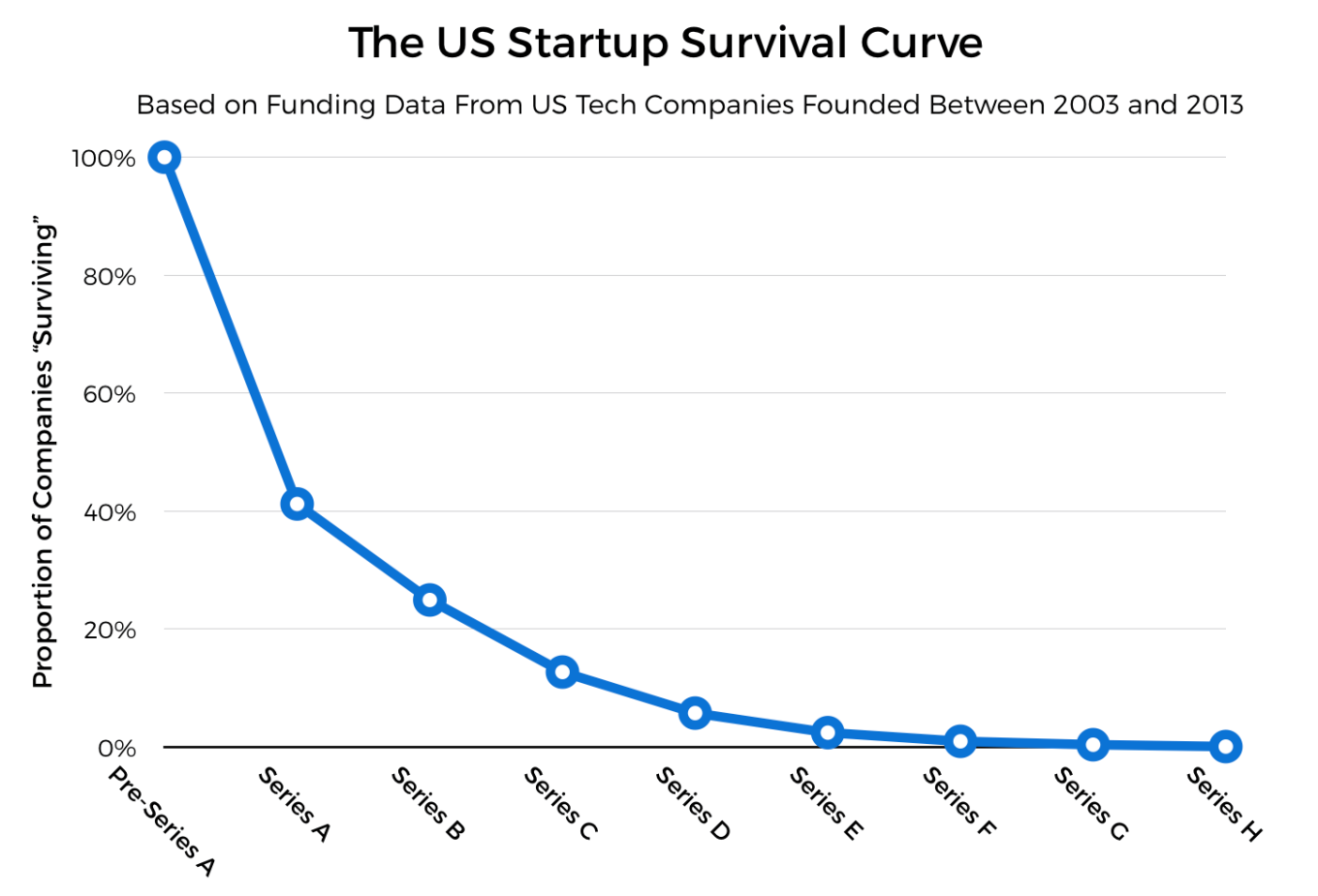

The number of rounds of funding raised by a company is a decent indicator of how likely the company is to succeed at some level. For example, a pre-series A startup going to raise a Series C round increases “survival” chance by over 80%.

This is what the startup’s funding timeline and valuation looks like:

| Date | Round | Amount Raised | Valuation |

| Jan 2017 | Pre-Seed | $120k | $1.8M |

| March 2017 | Seed | $2.1M | $22M |

| Sep 2019 | Series A | $11.9M | $57.99M |

| March 2021 | Series B | $50M | $462M |

| Feb 2022 | Series C | $30M | $1.3B |

The startup has a series-C post money valuation of around $1.3B which gives it unicorn status. And its valuation has improved each round. These are good signs.

Secondly, it’s always worth considering the pedigree of the investors. This startup is funded by the likes of Sequoia Capital, IVP, and Y Combinator – all Tier 1 investors. Joining a startup backed by a Tier 1 investor is one of the best ways to increase your chances of a positive outcome.

Unfortunately, joining a later-stage startup doesn’t guarantee life-changing equity. Usually, the later you join, the smaller your equity value when the startup exits.

Since joining this startup would mean joining it relatively late, you want to make sure to evaluate whether the company truly has major growth ahead of it (like SpaceX, Uber, and Stripe all did).

For example, according to analysis done by Prospect:

- Instacart employees that joined at Series C or beyond likely would’ve made more money if they’d joined a FAANG company or gotten paid in all-cash and invested that money into the market.

- Loom employees’ that joined at Series A and B raked in massive returns, and those who joined at Series C got a roughly market-average return (when looking at similar companies).

So entry points are important. In this case, we’d want to ask the startup the following questions when interviewing:

- When do you next expect to raise a round and at what valuation?

- What is your current 409A valuation?

- How much cash do you have and what’s your burn rate looking like? [this can also tell us about when they plan to raise their next round]

All else being equal though, the question then becomes about our confidence in determining whether this startup has outsized growth potential. There are two parts to this: their growth and the growth of the market they operate in.

Sorry to interrupt

I hope you're enjoying the article. In my next article, I investigate the Business of Takehome Assessments - enter your email and I'll deliver it straight to your inbox when it's out in 3 weeks.

Business Model

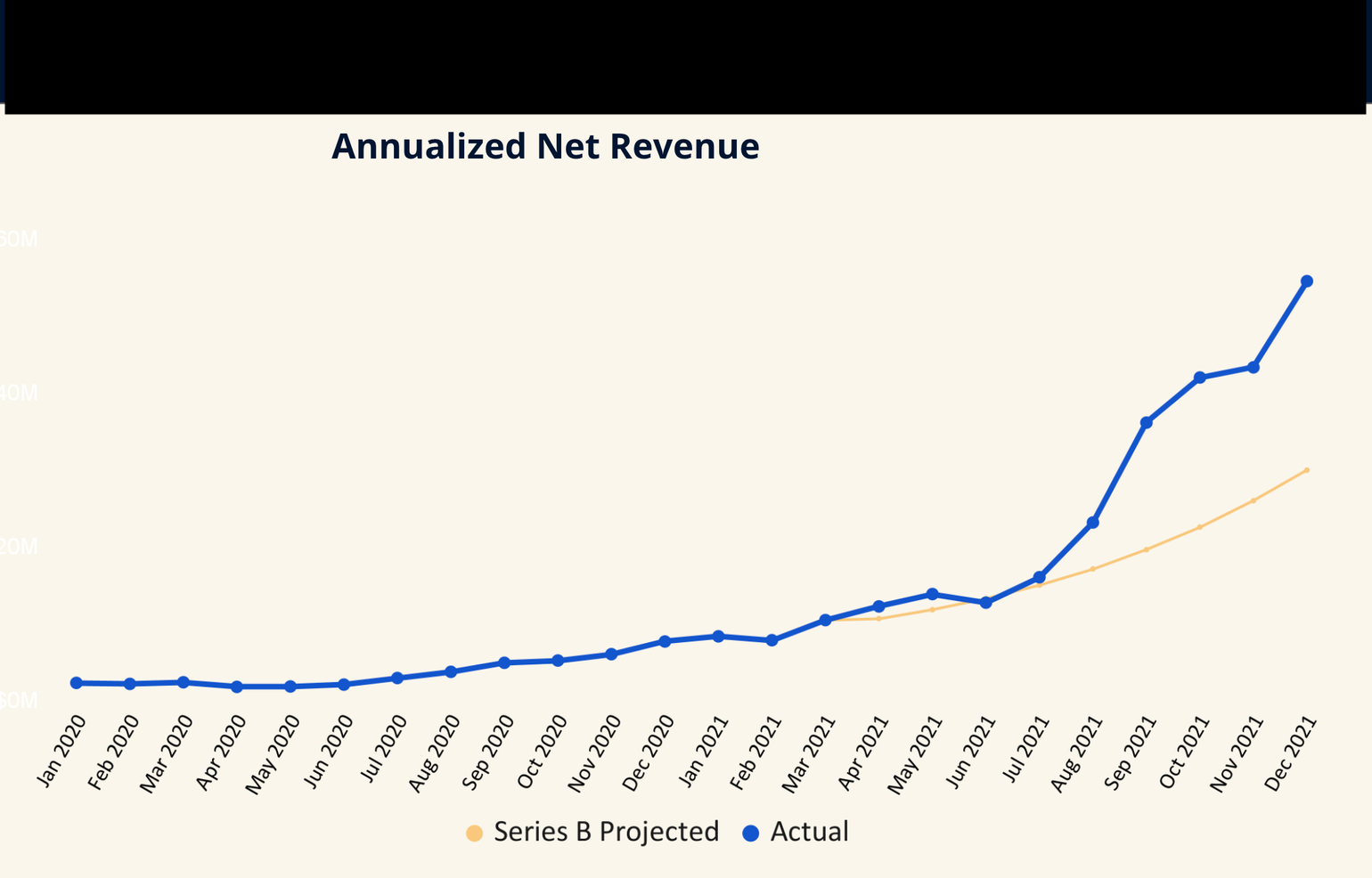

The startup is quite open about their numbers – their revenue grew 25x in the 18 months before they raised their Series C round:

On their website they state that they’re doing $100M in revenue and are profitable.

Sidenote: I would ask them whether this is gross revenue or net revenue. Keep in mind that because this startup classifies its workers as 1099 contractors instead of W2 full-time employees, they likely have strong net figures.

Their business model is that of a B2B marketplace -- they make money by charging a small commission fee on the money that a nurse gets paid out when working a shift at a hospital.

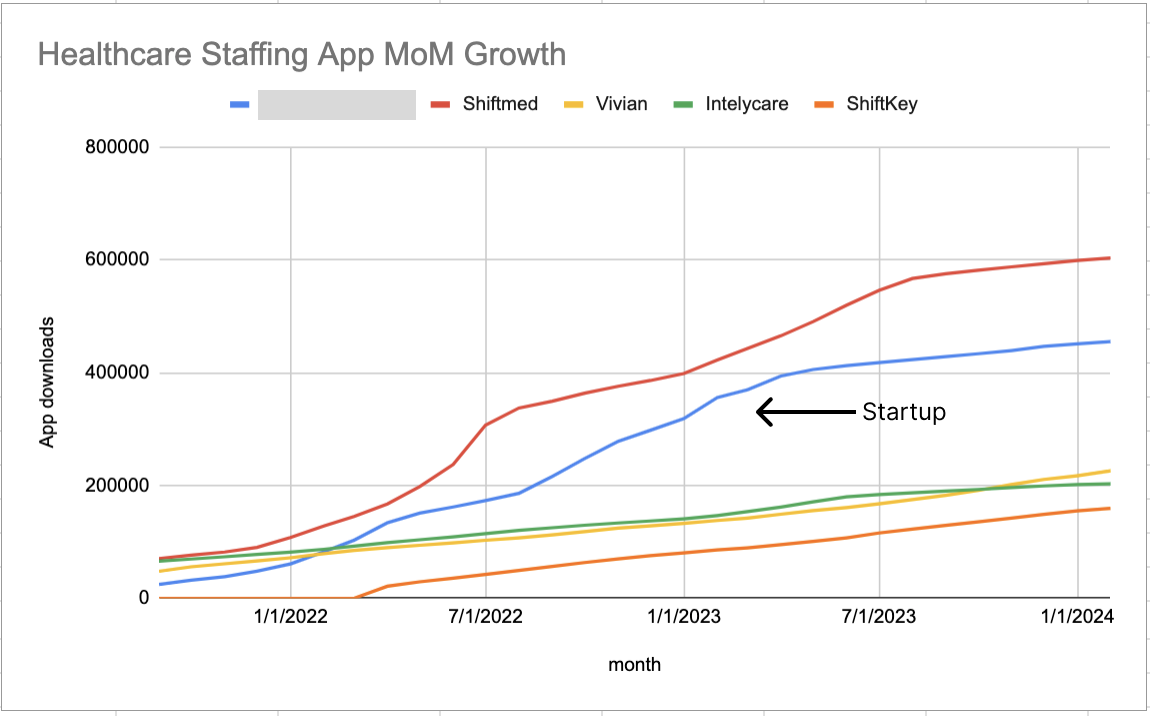

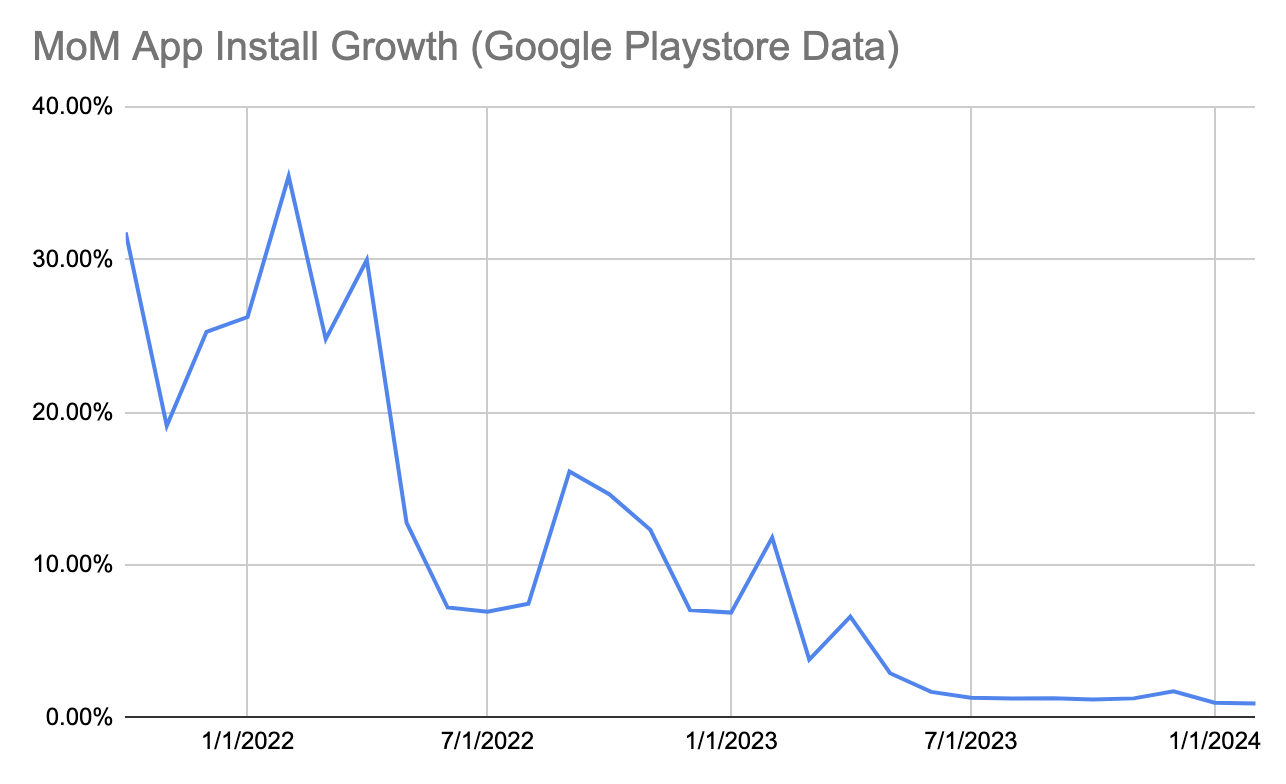

The more nurses use their app, the more they book shifts, the more money they make. Thus, app downloads can serve as a strong proxy to evaluate how well the business is doing:

The above data is only for the Google Play Store.

From the graph, we can see that the startup (in blue) experienced rapid growth from mid 2022 to mid 2023. Since then, though, app install growth has started to steadily decrease month over month:

They’re still averaging around 4k-5k downloads the last 6 months per month (Google Play Store Data only), but we’re not seeing the tremendous growth that we saw in early 2022. And this seems to be the case not just with this startup but its competitors too.

According to Aditya Gandhi, an Investment Associate at Andra, another crucial piece of information would be to verify how much of their revenue comes from fixed contracts as opposed to real time pricing via an actual marketplace dynamic.

The reason this is important is because fundamentally this startup is a staffing agency. They connect healthcare facilities with nurses. And if that’s happening mainly via fixed contracts, then you question if there is actually any innovation happening.

“You want to see evidence that the marketplace dynamic is strong, so say maybe a 50:50 split between placements via contracts and the marketplace, as opposed to something like 75:25“ says Gandhi.

This sentiment is also echoed by Garheng Kong, a managing partner at HealthQuest Capital, who told Business Insider: "If you don't have a heavy tech component, you don't really have a competitive advantage over the incumbents."

The Market

A rising tide lifts all boats.

The healthcare staffing market has exploded since the pandemic – over $700M in funding raised in 2022 and a huge new entry of startups in the space. ShiftMed recently announced a $200M funding round and Shiftkey announced a $300M funding round.

This is all driven by an acute nursing shortage. According to the Bureau of Labor Statistics, the gap between healthcare job openings and hires rose to more than 1,000,000 when COVID struck. The pandemic meant that startups in this space saw accelerated growth and rising valuations.

There are some signs that things are improving. In late 2023, the Biden administration approved over $100M to grow the nursing workforce. The number of candidates who are passing the nurse licensure exam for the first time is continually growing; and the registered nurse workforce is also growing.

One of the big appeals of such gig platforms, though, is that they tend to provide higher pay and greater flexibility to nurses (well, aside from the legal issues we discussed in this article). They’re a welcome relief to alternatives like month-long contracts which can lead to burnout. And for the hospitals, they provide the ability to get someone to pick up a shift right away. As reported by Barrons, Aya Healthcare (another gig hiring provider) saw a 54% rise in the number of gig shifts filled by nurses in the last year.

I don’t necessarily foresee this trend changing, but would ask the startup some of the following questions:

- How have your daily active users trended over time? Is there an explanation for the decrease in app downloads MoM (at least for the Google Play Store)?

- How do you evaluate renewed investment in this space?

- How do you differentiate yourself compared to your competitors? Are you a full-on tech enabled marketplace or do you also operate with fixed contracts?

Culture

The economics of a startup might certainly dictate your livelihood, but they aren’t going to crush your soul on a Monday morning. You know what will? A bad boss. A rude coworker. A fridge with no diet coke.

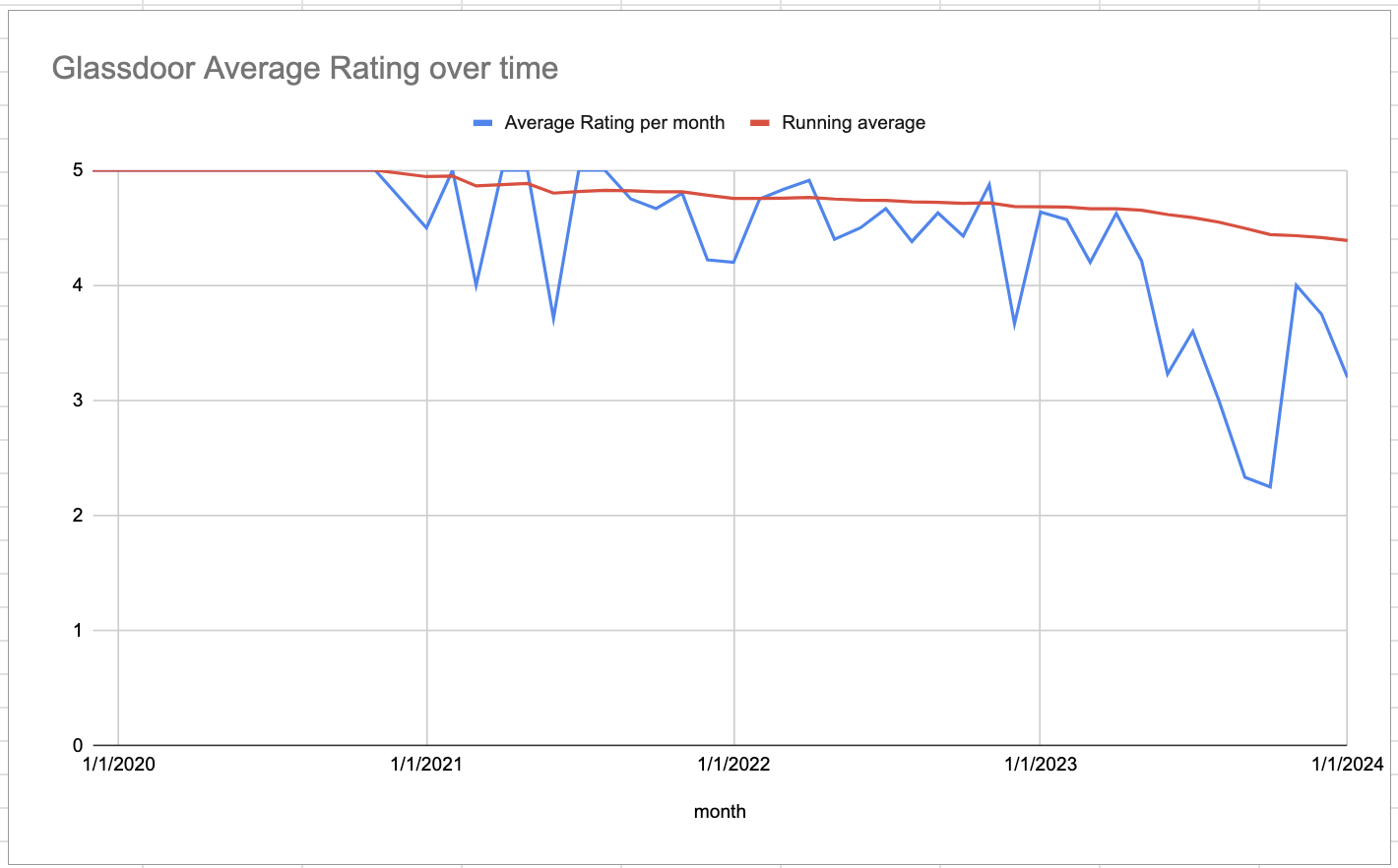

You get the point: you don’t want to work with assholes (and without diet cokes). The obvious place to start is by looking at their Glassdoor reviews. I’ll save you a full-on dedicated analysis, but let’s start by first looking at their average monthly rating over time for the past four years:

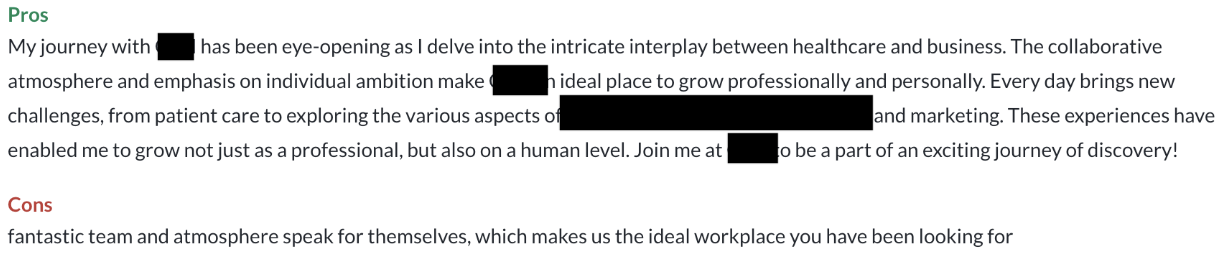

The cumulative average is a 4.3, but it’s been trending downwards over time. If you take a closer look at their reviews, you start to notice that they look almost a bit formulaic. Take this one for example:

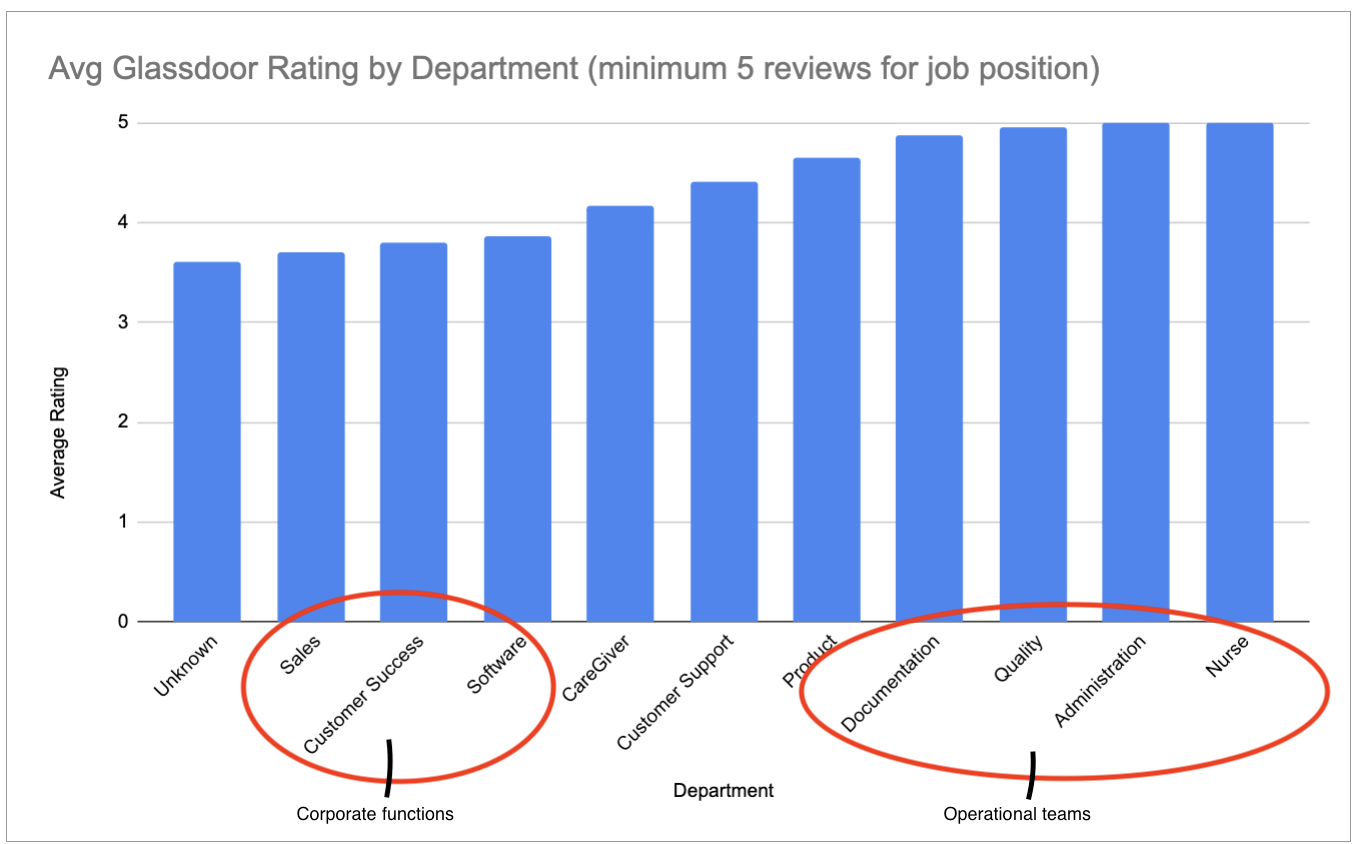

Let’s dive a bit deeper and look at the rating breakdown by department:

Sales, Customer Success, and Engineering teams report lower ratings than the administrative or operational teams. A 3.5 average rating isn’t necessarily “bad”, but it’s interesting to note that the administrative functions inflate the overall Glassdoor average.

Right, so, next up let's see what we can learn about their interview process. According to a bunch of different online forums, the interview process is quite polarizing:

It looks like the startup makes its applicants do a bunch of take-home work (we’re talking about ~10 hours of work) and then often doesn’t give much feedback. This isn’t great behavior.

I’ve always been curious about the usage of take-home assessments, so I asked Alan Stein, founder of Kadima Careers, why companies issue them and their goal. According to him:

"Companies are lazy. This is an easy way to weed out candidates that aren't serious, and as the companies have the power in the candidate-company relationship, companies can add this extra hurdle into the mix. At least highly sought-after companies like what Google and Amazon are now starting to do."

The startup acknowledges the upfront time investment, but state that it gives candidates a good idea of what type of work they'd be doing on the job. And ultimately helps both parties find a good match.

Note: I don't condone the fact that they seem to give insufficient/no feedback to the amount of work people put in. This is a bad reflection on their interview process.

Something else I notice is that they place a strong emphasis on writing. There is extensive documentation available about most of their teams. As an applicant, I’d have a pretty good idea of the type of organization that I’m stepping into just by virtue of doing my research – one of the quotes on their website puts it nicely:

“Every document below is an example of how we think."

The more information that is provided to me upfront, the better I’m able to evaluate whether I want to proceed. I see this as a positive signal.

And contrary to the backlash against their application process online, I don’t necessarily mind engaging in work upfront if it means that both parties have a better understanding of what they’re getting into.

Conclusion

This startup “fails” my background check if I find enough red flags that would dissuade me from moving forward in their application process. Was I able to do that?

| Dimension | Red Flags Identified |

| Legal |

|

| Financial |

|

| Culture |

|

It’s true, we found some red flags. Some pretty interesting ones. But if I got good answers to the questions we identified in each section above, I would move forward with their application process.

Specifically, I would want good answers to the growth they forecast ahead. And the legal side of things especially if pressure from the Department of Labor continues to mount.

I think outside of metrics like Glassdoor ratings and to some extent attrition data available on Linkedin, culture is the hardest to evaluate.

Their Glassdoor reviews seem to be a bit sketchy and there is definitely something off about the ratings. The comments online about their interview process aren’t encouraging.

However, the same workplace that is bad for some might be good for others. Their writing based culture appeals to me and suits my personality.

Yes, there are red flags to look out for but a lot of it will come down to face to face conversation with the people you work with.

Finally, the financial side of things looks good. There is a proven business model in a growing market, though there are signs of app-download stagnation. I still, however, think that there is enough growth ahead in this market.

So there you have it: a background check from the candidate side. Not even the best VCs in the world would be able to tell you what’s going to happen to a startup, but there are certainly things you can do to improve your odds.

There are experts you can email. Reviews you can analyze. Industry reports you can read. Founder interviews that you can watch.

So do the work. And may the odds be ever in your favor.

Until next time,

Shikhar

You might also enjoy reading:

Next up

I hope you enjoyed the piece. In my next article, I investigate the Business of Takehome Assessments - enter your email and I'll deliver it straight to your inbox when it's out in 3 weeks.

Feel free to hit me up on Twitter or email me. Here's my Linkedin.

Continue browsing the site.

Article cover image credit to Humberto